Procedure Library

Sponsored Projects

Policies & Compliance

- Research Handbook

- 1. Roles & Responsibilities

- 2. Standards for Conduct of Research

- 3. Overview of Sponsored Projects Administration

- 4. Funding Sources & Opportunities

- 5. Proposal Development

- 6. Budget Development

- 7. Procedures for the Submission of Proposals

- 8. Award Acceptance

- 9. Award Management

- 10. Research Related Regulations, Policies & Procedures

- 11. Other Conduct of Research Issues

- 12. Acronyms & Definitions

- 13. Glossary

- Procedure Library

- Regulations Library

- Export Controls

Total Federal Funds Awarded (TFFA) F&A Calculation

Purpose

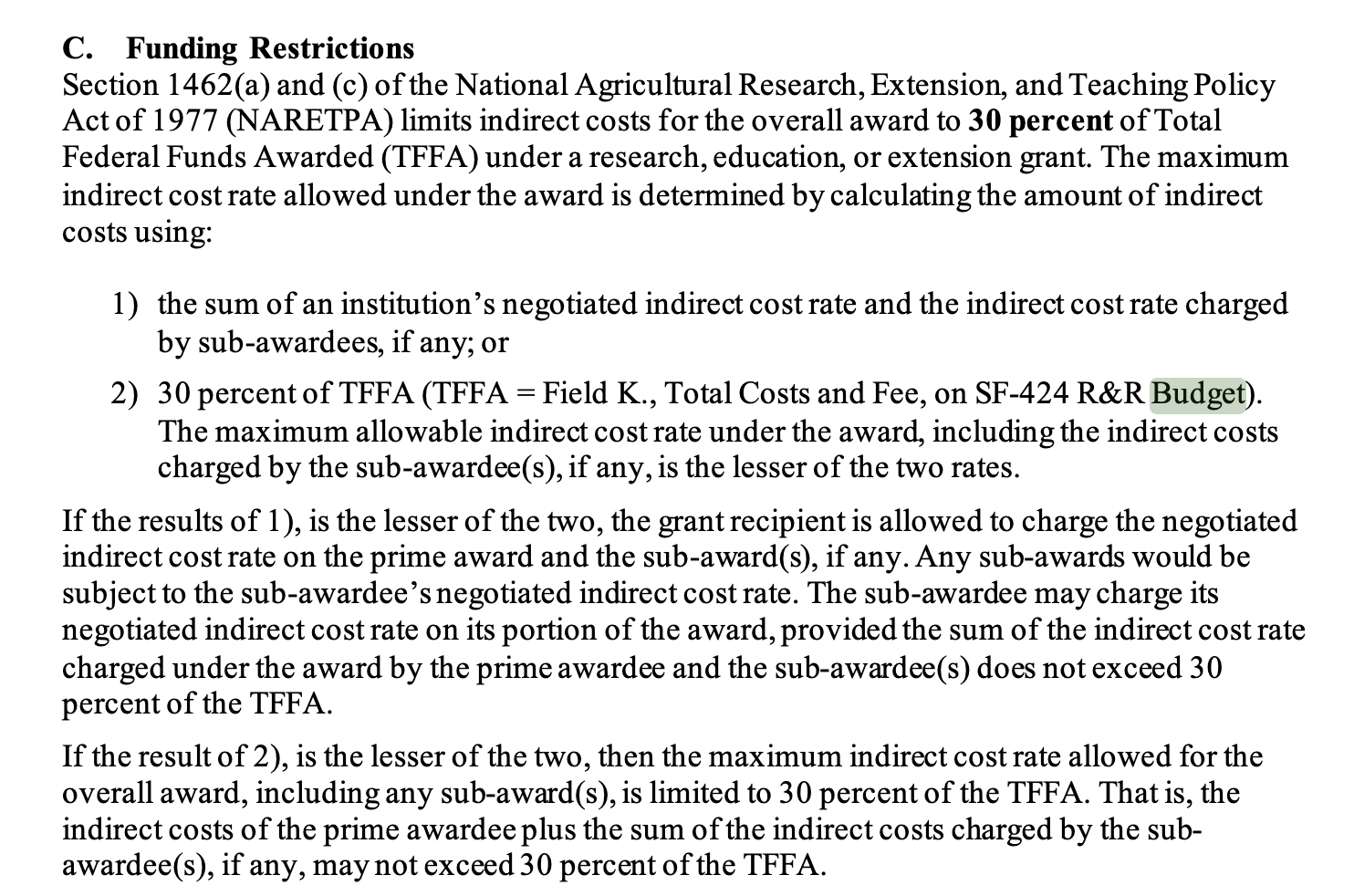

For many US Department of Agriculture (USDA) National Institute of Food and Agriculture (NIFA) awards, indirect costs are limited by federal legislation. Because of this federal mandate, NIFA applicants must follow all indirect cost limitations listed in the NIFA Request for Applications (RFAs).

Applicability

Principal Investigators (PIs) and administrators proposing a sponsored project may need to apply the most common NIFA indirect cost cap of 30% of Total Federal Funds Awarded (TFFA). NIFA can only accept the lesser of the University's current negotiated rate or 30% of TFFA awarded.

An example of a TFFA funding restriction:

If PIs are proposing subawards, the subawardee may charge its negotiated indirect cost rate on its portion of the award, provided the sum of the indirect cost rate charged under the award by the prime awardee (the University of Utah) and the subawardee(s) does not exceed 30 percent of the TFFA. Subawardess, just like prime awardees, must apply the lower of their negotiated rate or the 30% TFFA.

If the University of Utah is a planned subrecipient, the UU PI, just like the prime awardee, must apply the lower of their negotiated rate or the 30% TFFA.

Instructions

In some cases, determining the lower of the two rates (the institution’s negotiated rate or 30% TFFA) is relatively simple.

| Total Direct Costs (including $30k in equipment) | $200,000 |

| 52% F&A Research MTDC (base: $170,000) | $88,400 |

| 30% TFFA (~42.857% TDC) | $85,714 |

In the above example, 30% TFFA ($85,714) must be used because it is less than the

institution’s calculated indirect cost rate ($88,400).

More challenging situations occur when there are subawards and cost-sharing involved. In both of these cases, the prime awardee is responsible for ensuring that the maximum indirect cost allowable is not exceeded when combining the Federal portion (prime and subawardees) and any applicable cost-sharing. Use this TFFA subaward calculator

Because the calculation of 30% TFFA can be confusing when subawards and cost-sharing are involved, NIFA has published a list of Frequently Asked Questions (FAQs) which includes budget scenarios and guidance for calculating indirect costs under each scenario. Below is an example of determining which indirect cost amount to use when a subaward is involved.

| Total Direct Costs (including a subaward of $120k) | $200,000 |

| 52% F&A Research MTDC (base: $105,000) | $54,600 |

| 30% TFFA (~42.857% TDC) | $85,714 |

In this example, the amount of the institution’s negotiated indirect cost rate is

less than 30% of TFFA. However, we must also account for the amount of F&A the subrecipient

is requesting. If the combined amount requested by the prime awardee and subrecipient

puts the request over 30% TFFA, then only 30% TFFA can be requested. Add to that,

the subrecipient is subject to the same 30% TFFA cap as the prime awardee.

When we take the subrecipient’s F&A into account, we find that combined we are over the 30% TFFA.

| Total Direct Costs (including a subaward of $120k) | $200,000 |

| 52% F&A Research ($54,600) + Subawardee 30% TFFA ($51,428) | $106,028 |

| 30% TFFA (~42.857% TDC) | $85,714 |

In this updated example, the combined amount of prime awardee and subrecipient F&A

is greater than the TFFA.

In situations where the combined prime and subawardee indirect cost amounts are greater than 30% TFFA, the prime and subrecipient must agree on an allocation of indirect costs that makes sense. In these situations, communicating NIFA’s limitation on indirect costs is vitally important. Also, subawardess, just like prime awardees, must apply the lower of their negotiated rate or the 30% TFFA.

For administrators needing assistance determining which indirect cost rate to use on a NIFA proposal, OSP has a calculation tool available.

Be notified of page updates

Procedure Library Feedback

Do you have comments or suggestions for this procedure?